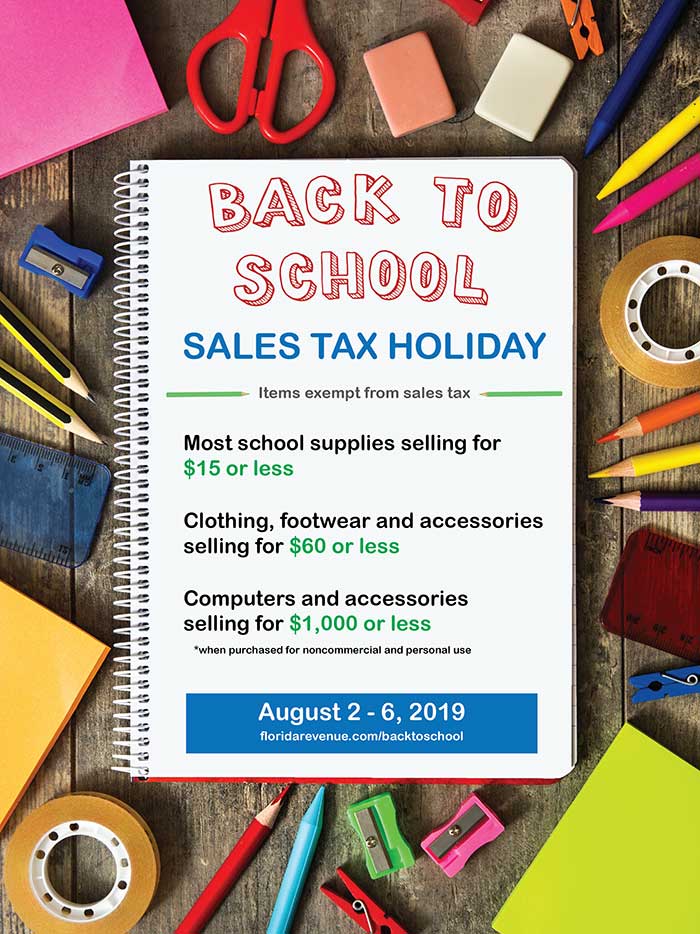

It's hard to believe that summer break is drawing to a close and that the kids will soon be going back to school. For many of us, the back to school to-do list includes shopping for new clothes and school supplies. Thankfully, the state of Florida is providing us with a Back to School Sales tax Holiday again this year and it's been extended to go beyond the weekend. The sales tax holiday starts at 12:01 AM on Friday, August 2, 2019 and ends at 11:59 PM on Tuesday, August 6th.

To make things a little easier for you, we went to the Florida Department of Revenue's website to check out what's included this year and we compiled a quick list of some of the main qualifying items. We've included the dollar amount limit on each item if applicable.

- School Supplies (most items) - up to $15 per item

- Clothing: up to $60 per item

- Footwear: up to $60 per item

- Computers and certain accessories selling for $1,000 or less per item, when purchased for noncommercial or personal use

Internet or mail-order - note that eligible items purchased online or through a mail-order catalog during the sales tax holiday period qualify as tax free even if delivery occurs after the tax holiday period ends.

TAXABLE ITEMS: Some common items that we may think of as supplies that DO NOT qualify for a tax free exemption include: most books (not otherwise exempt), computer or printer paper, correction tape, fluid or pens, and masking tape.

If you will be visiting a theme park or tourist attraction during the tax-free holiday, keep in mind that items purchased at theme parks, entertainment venues, or travel spots (think hotels & airports) do not qualify for the tax free exemption, even if they are school supply type items like pens, pencils, notepads, etc.

You can find a complete list of tax-exempt items by visiting the Florida Department of Revenue’s Back to School Sales Tax Holiday web page.